GST Login

The Goods and Services Tax (GST) is India’s biggest indirect tax reform, introduced 1 July 2017. It unified earlier taxes and made compliance easier. Here’s all you need to know about GST, GST Login & its benefits!

What is GST?

GST is one single indirect tax for the supply of goods and services across India. It replaced complex multi-tax systems (excise, VAT etc.). Now you pay one tax, transparently.

Example: Before, a product had 3-4 hidden taxes. Now, GST has just one visible tax.

GST Status & Login

GST Structure: CGST, SGST, IGST

- CGST: Central GST, for intra-state supplies (imposed by Centre).

- SGST: State GST, for intra-state supplies (imposed by State).

- IGST: Integrated GST, for inter-state trade and imports.

Key Benefits of GST

- Eliminates cascading tax effect (no “tax on tax”)

- Simple & transparent rules

- Facilitates nationwide trade

- Boosts ease-of-doing-business

- All compliance online—register, return, payment

GST Rates & Slabs

Rates are set at 0%, 5%, 12%, 18%, and 28% depending on items. Basics on lower rates, luxury/high-sin goods on highest. Periodic Council reviews possible.

Impact on Consumers & Businesses

- Consumers: Prices should fall, transparency improves.

- Businesses: Changes in billing, accounting, and compliance.

GST Challenges

- Initial tech adjustment for small businesses

- Multiple rates create some complexity

- System is evolving, ongoing reforms expected

GST Login Process

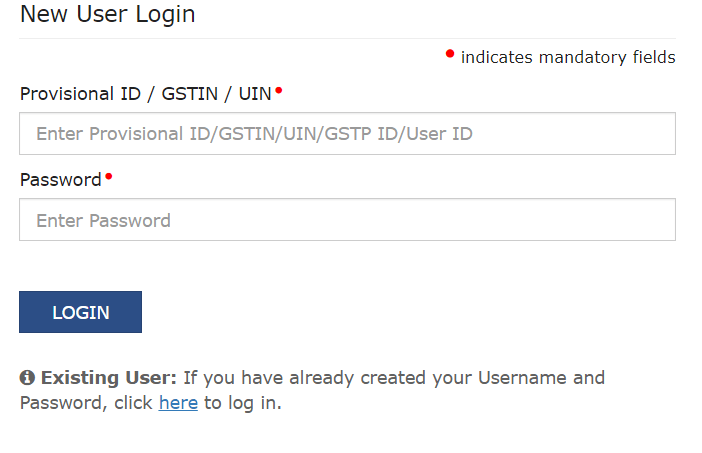

If you are a first-time user:

- Visit https://www.gst.gov.in/

- Click Login top right.

- Click “First time login? Click here to login”

- Enter your Provisional ID/GSTIN/UIN & password.

- Enter captcha, click LOGIN.

- Set new username & password.

- Log in with new credentials.

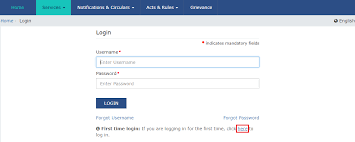

If you are an existing user:

- Visit https://www.gst.gov.in/

- Click Login, fill your credentials and captcha, proceed.

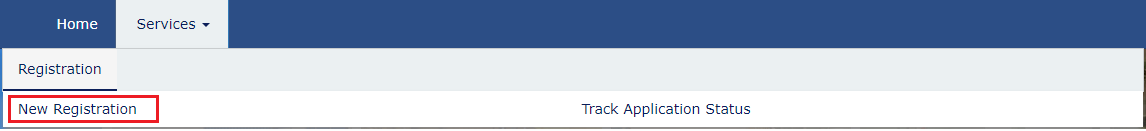

GST Registration Process

- Visit GST Portal

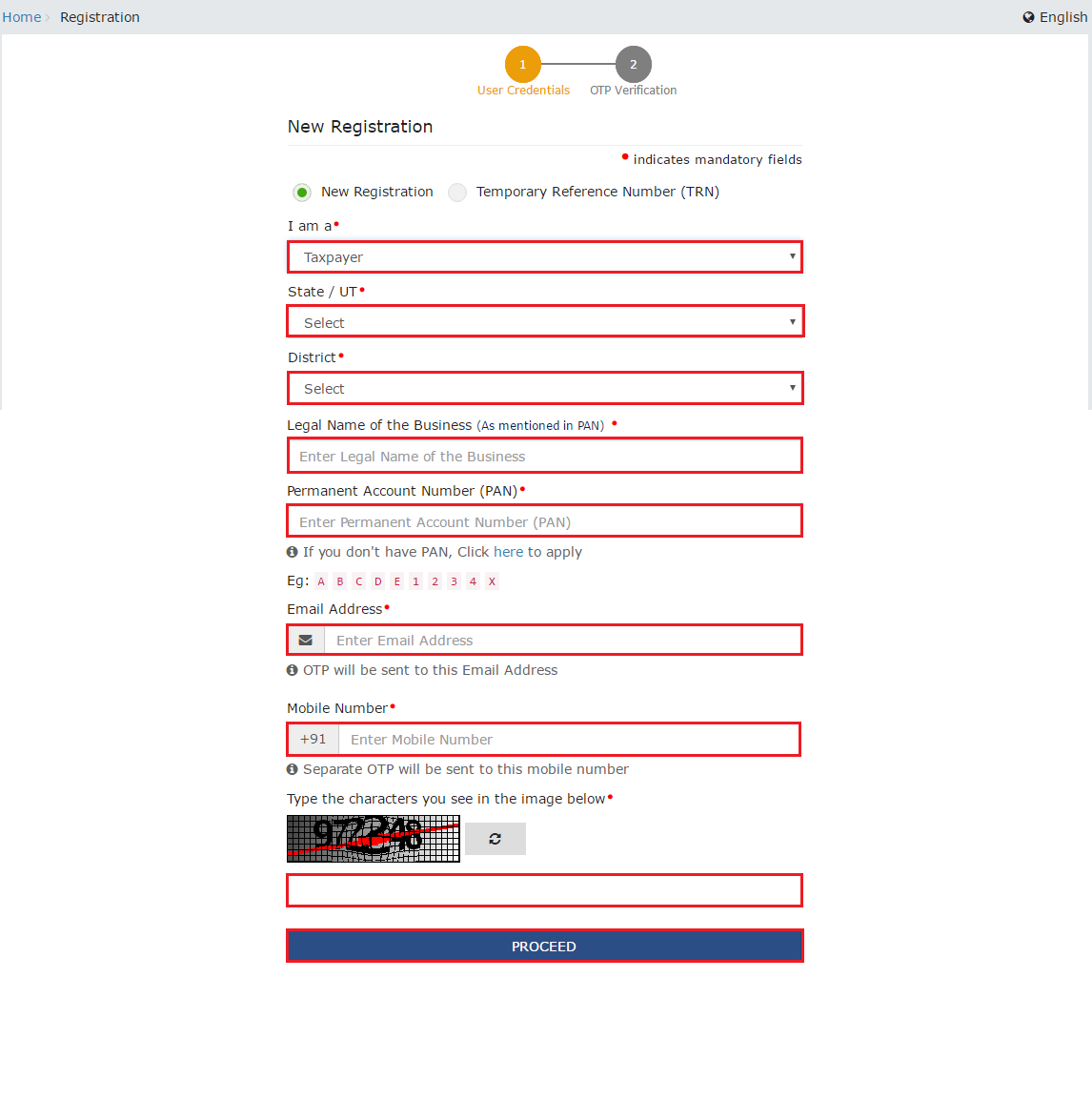

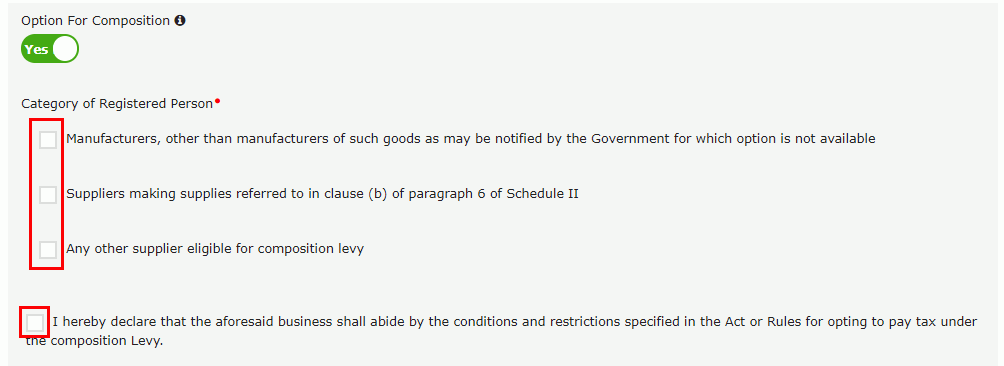

- Go to Services > Registration > New Registration or Register Now.

- Fill Part A - basic details (business info, PAN, mobile, etc.)

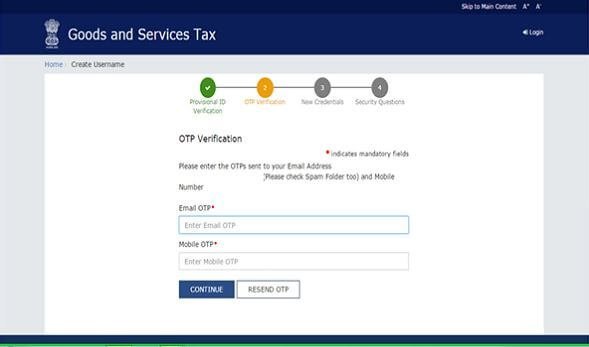

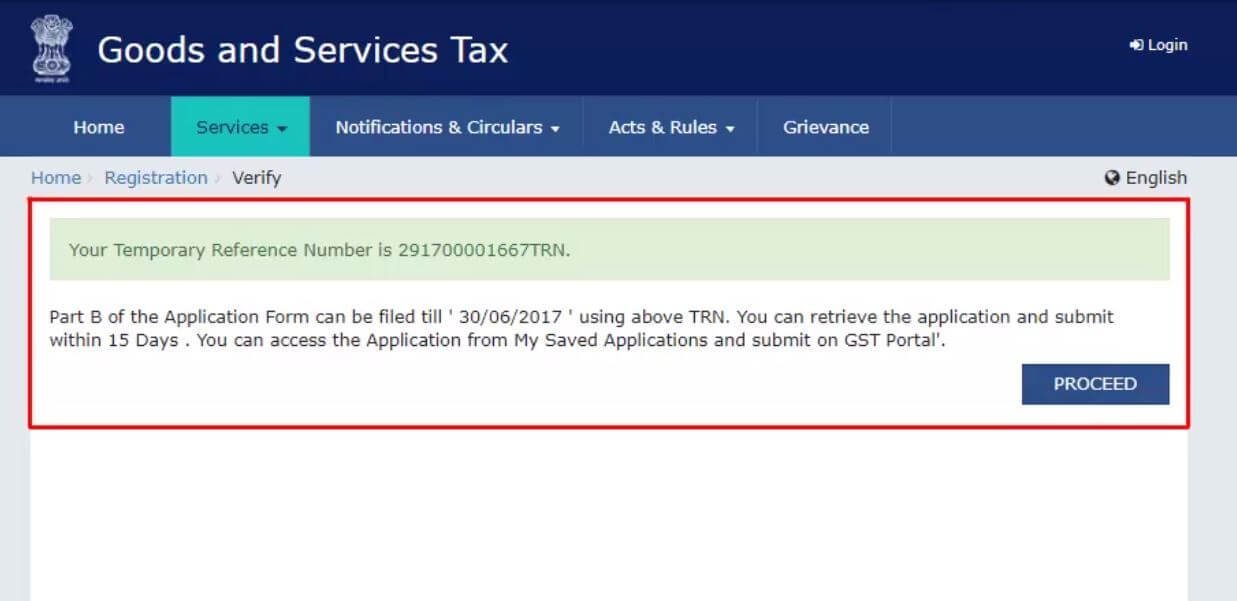

- OTP verification, note your TRN.

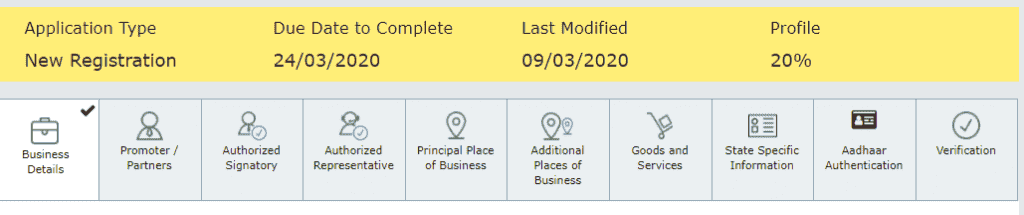

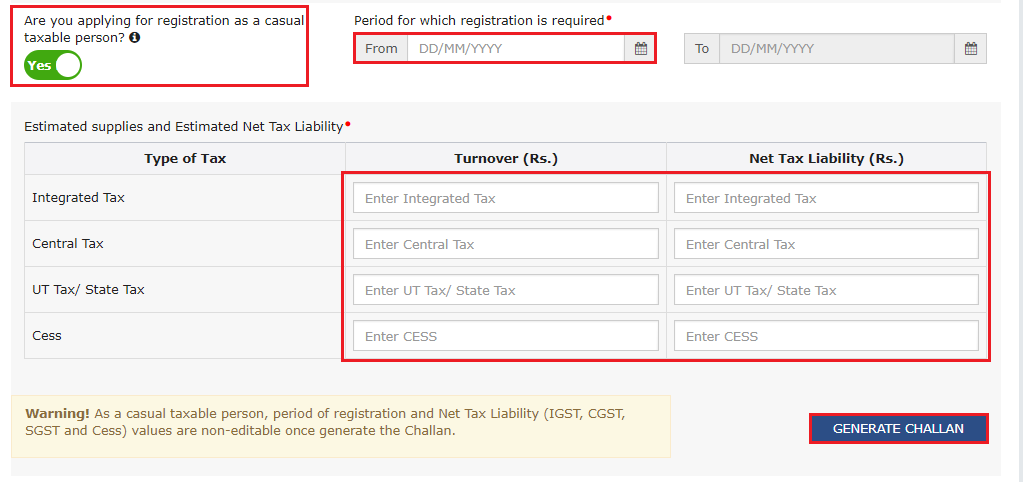

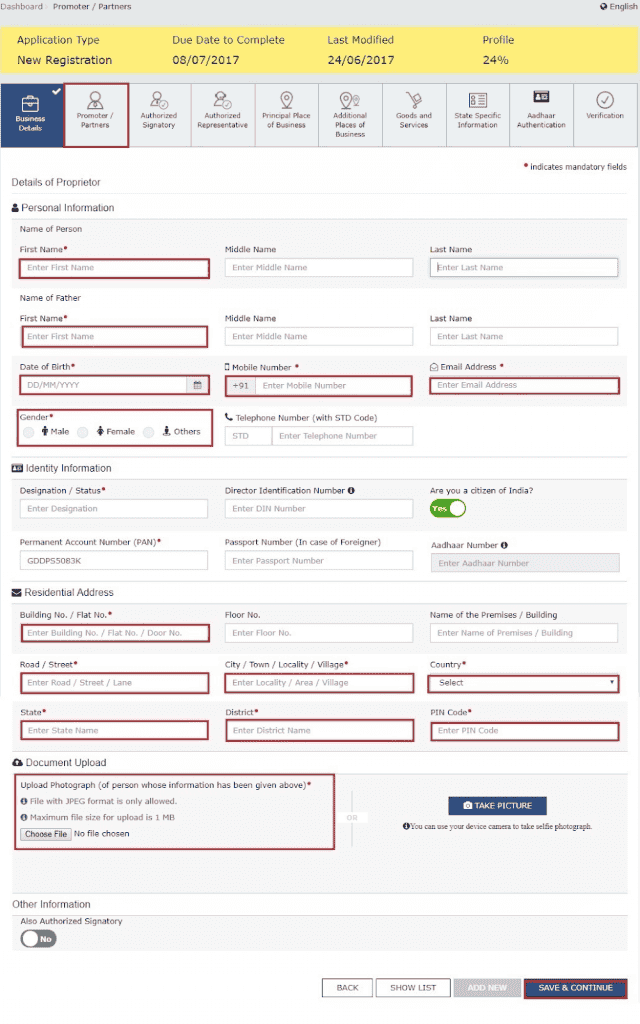

- Part B - re-login with TRN, fill detailed info, upload docs

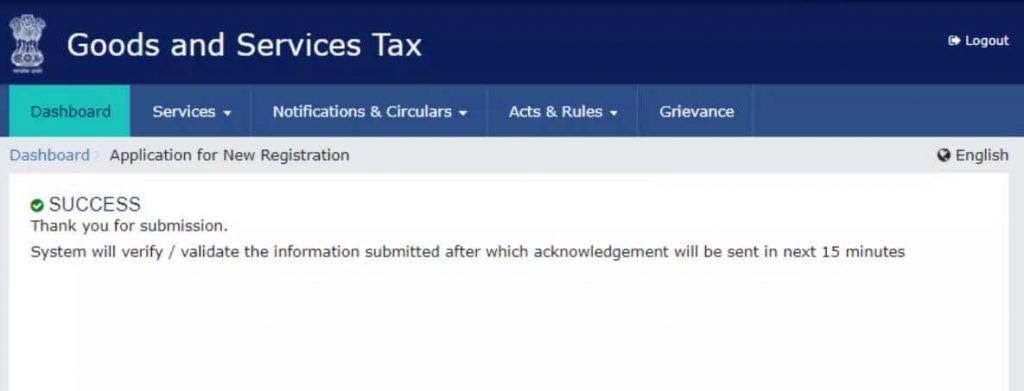

- Verification, upload docs, submit return.

- Acknowledgement via ARN, application reviewed, GSTIN granted on approval.

Note: Keep all documents ready before starting.

GST Registration Status

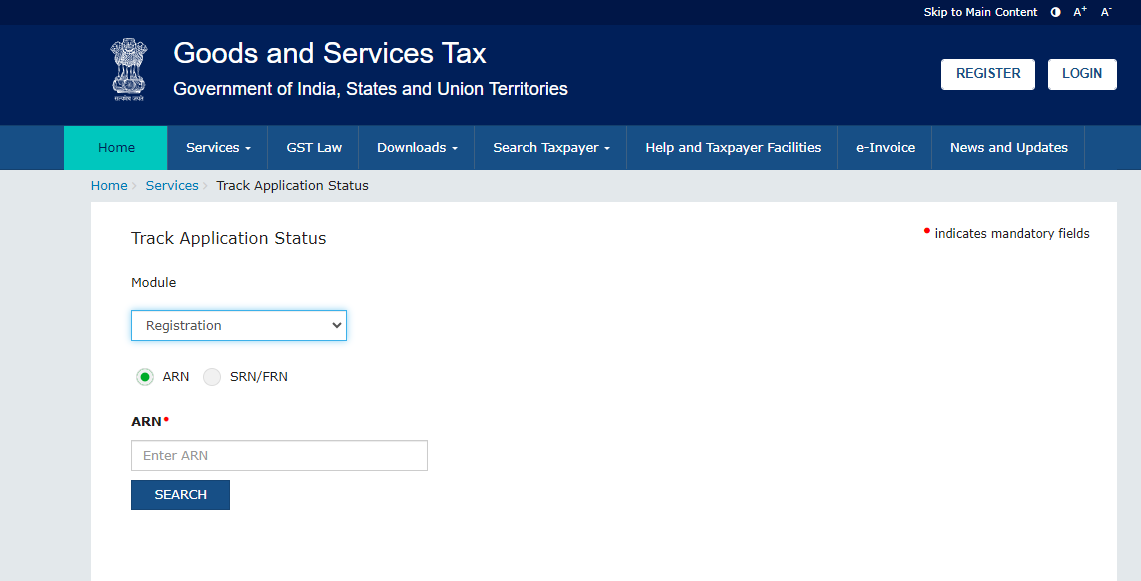

Before Login (Using TRN or ARN)

- Go to GST Portal > Track Application Status

- Enter TRN/ARN, captcha — view current status

After Login (Using ARN or Period)

- Login > Services > Track Application Status

- Enter ARN/date range — see status or download acknowledgement PDF.

Possible Application Statuses

- Pending (processing)

- Pending for clarification

- Clarification filed, pending for order

- Approved

- Rejected

- Withdrawn

- Site verification assigned/completed

Tip: Respond quickly to clarification requests to avoid delay!

In Conclusion

GST is a transformative tax system. For both businesses and consumers, understanding GST, its login/registration processes, and regular status checks is crucial for compliance and smooth trade!

FAQ's

What is GST?

Goods and Services Tax — India’s current indirect tax system.

Who needs to register?

Businesses over threshold limit, inter-state suppliers, and others.

Types of GST?

CGST, SGST, IGST, UTGST

What is GSTIN?

GST Identification Number — unique number for every registered taxpayer.

How are rates decided?

By the GST Council, based on slabs (0%, 5%, 12%, 18%, 28%).

What is the GST portal?

Official site: gst.gov.in

What is e-invoicing?

Electronic invoices generated on GSTN for large businesses.

What are GST returns?

Monthly/quarterly filings listing your sales & purchases.

What is Input Tax Credit?

Allows businesses to claim credit against tax paid to vendors.

How to pay GST?

Online via GST Portal; NEFT, card, net banking, or authorized banks.